Australians appetite for computer and electronic equipment continues, according to Sum Insured’s annual Australian Residential Contents Index (RCI).

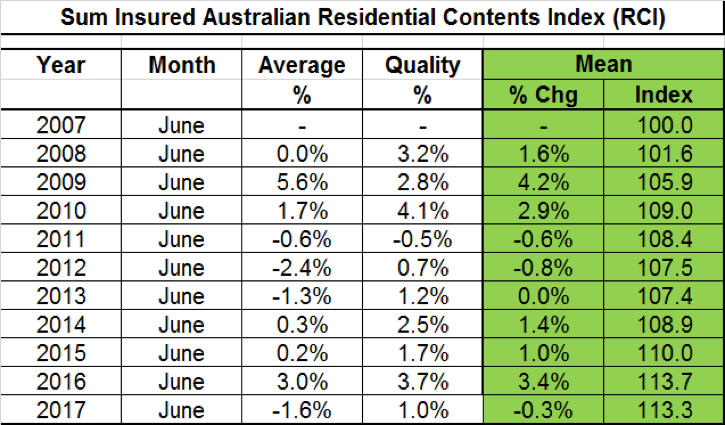

Sum Insured’s Residential Cost Index (RCI) research measures the movement in home contents replacement costs in Australia. The latest RCI revealed replacement costs fell marginally by 0.3% in the 12 months to July – a year after rising by 3.4% in 2015-16.

Sum Insured’s Commercial Director, Mike Bartlett, said while the cost to replace household goods slightly dipped, homeowners purchased more electronic items such as televisions, laptops, notebook computers and audio-visual equipment such as Bluetooth speakers.

The research showed item costs across the majority of the 13 key categories mostly fell, on the back of a competitive retail environment brought about by low wages growth and rising household costs, such as gas and electricity, meaning lower household disposable incomes.

“However, this trend was at least partially offset by homeowners acquiring greater levels of home contents, particularly items such as computers and other electronic equipment,” said Bartlett.

“Whereas households previously had one desktop computer at home, it is now very common for multiple persons in a household to have a laptop, notebook computer, computers with multiple screens, and a smart phone.

“Mobile phone technology continues to evolve and people are regularly upgrading to the latest device to accommodate their digital needs and lifestyle.

“Similarly, home entertainment systems are becoming more sophisticated and TV screens are becoming bigger, have superior visual quality and are more versatile,” he added.

Despite the price of replacement household goods remaining flat, Bartlett advised homeowners not to compromise their home contents insurance.

“Despite current financial pressures, underinsuring home contents can be fraught with danger and homeowners should ensure they are adequately covered in case they encounter a severe event,” he said.

“Rather than reduce their contents insurance, I suggest homeowners shop around to get the product that best suits their needs for the most affordable price,” he added.

About Sum Insured’s RCI

Sum Insured’s detailed cost survey involves over 2,000 items in 32 separate categories and includes appliances, audio visual and computers, through to clothing, cosmetics, furniture, games and toys, homewares and sports equipment.

All the major retailers are represented in the survey together with more than 400 smaller retailers, and involves almost 250,000 prices.

Home contents insurance changes are monitored daily from a wide cross section of Australian retailers via web, telephone, email and field research.

Sum Insured’s RCI is based on the contents of a typical three bedroom, two bathroom home with a garage containing two adults and two children.